Tax Season 2022

Welcome to tax season 2022, which covers returns filed for the 2021 tax year.

Some Helpful Videos to Guide You Through the Tax Prep Process

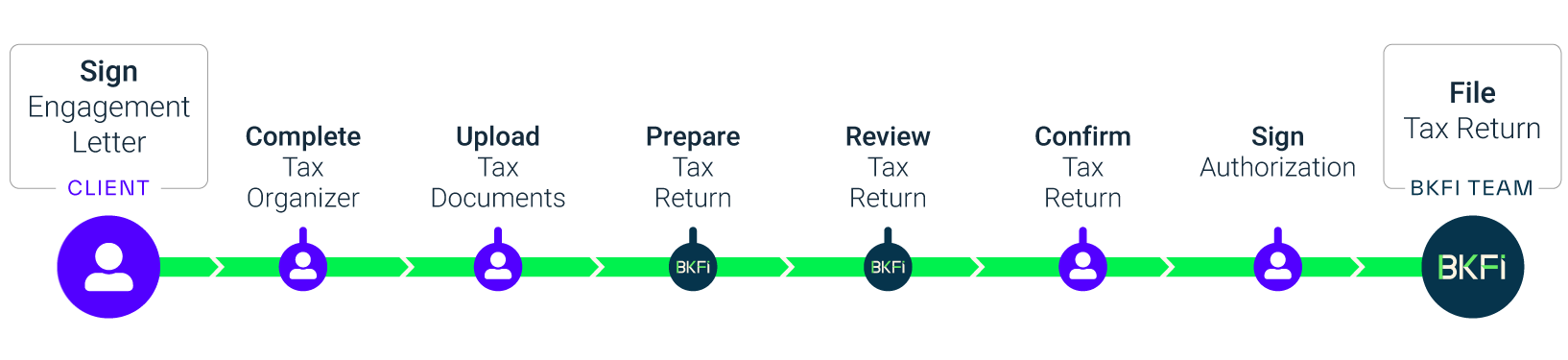

The Tax Prep Process at Brooklyn FI

1. You sign your engagement letter by January 31st

2. You complete our tax organizer and upload your documents by February 28th to a secure checklist sent to you via email

3. We spend a few weeks getting the return prepared and uploaded for review

4. You review the draft return and sign a Docusign authorization

5. We submit the return to the IRS and your state

If you have any questions, please contact support@brooklynfi.com

IRS Deadlines + Internal Brooklyn FI Deadlines

SIGN UP FOR OUR TAX DEADLINE NEWSLETTER

You don’t want to miss these.

January 15th - Deadline to make your Q4 estimated payment for the prior year

January 31st- Deadline to mail 1099s to contractors

January 31st - Brooklyn FI deadline to sign your engagement letter

February 28th - Brooklyn FI deadline to complete your tax organizer and upload your tax documents

March 15th - Deadline for S-corps and Partnerships to file a tax return OR request an extension

April 15th - Deadline for individuals and C-corps to file a tax return OR request an extension

April 15th - Deadline to make IRA contributions for the prior year

April 15th - Deadline to make your Q1 estimated payment

June 15th - Deadline to make your Q2 estimated payment

September 15th - Extended deadline for S-corps and Partnerships to file a tax return

September 15th - Deadline to make your Q3 estimated payment

October 1st - Deadline for business owners to elect a safe-harbor 401(k) for employees

October 15th - Extended deadline for individuals to file a tax return

October 15th - Extended deadline for individuals to make a SEP-IRA contribution (only if the extension was timely filed by 4/15)

January 15th - Deadline to make your Q4 estimated payment

Tax Season FAQs

How do I track how many days I spent in the US if I live abroad?

You can request form I-94 which tracks when you enter and exit the US. Go to the official I-94 website and select “Get Most Recent I-94.” Upload this to your tax organizer.

If I’m married, is it better to file jointly or separately?

It really depends! For MOST people, filing jointly will result in a smaller tax bill. Here are some of the credits and and advantages you LOSE when you file separately: the child and dependent care credit, the Earned Income Credit, the deduction for student loan interest, education and tuition credits, Roth IRA contributions. That said, it can make to file separately if one spouse has significant medical expenses (more than 10% of the income for the year) or other itemized deductions. When we prepare your tax return we will inform you if it might make sense to file separately (it’s rare!).

Are my charitable contributions deductible?

Typically, charitable contributions are only tax-deductible if you elect to itemize your deduction (not take the standard deduction) but there is a special carve-out for the tax year 2021 that enables every taxpayer to deduct $300 in charitable contributions on their tax return. The deduction is doubled to $600 for married couples filing jointly.