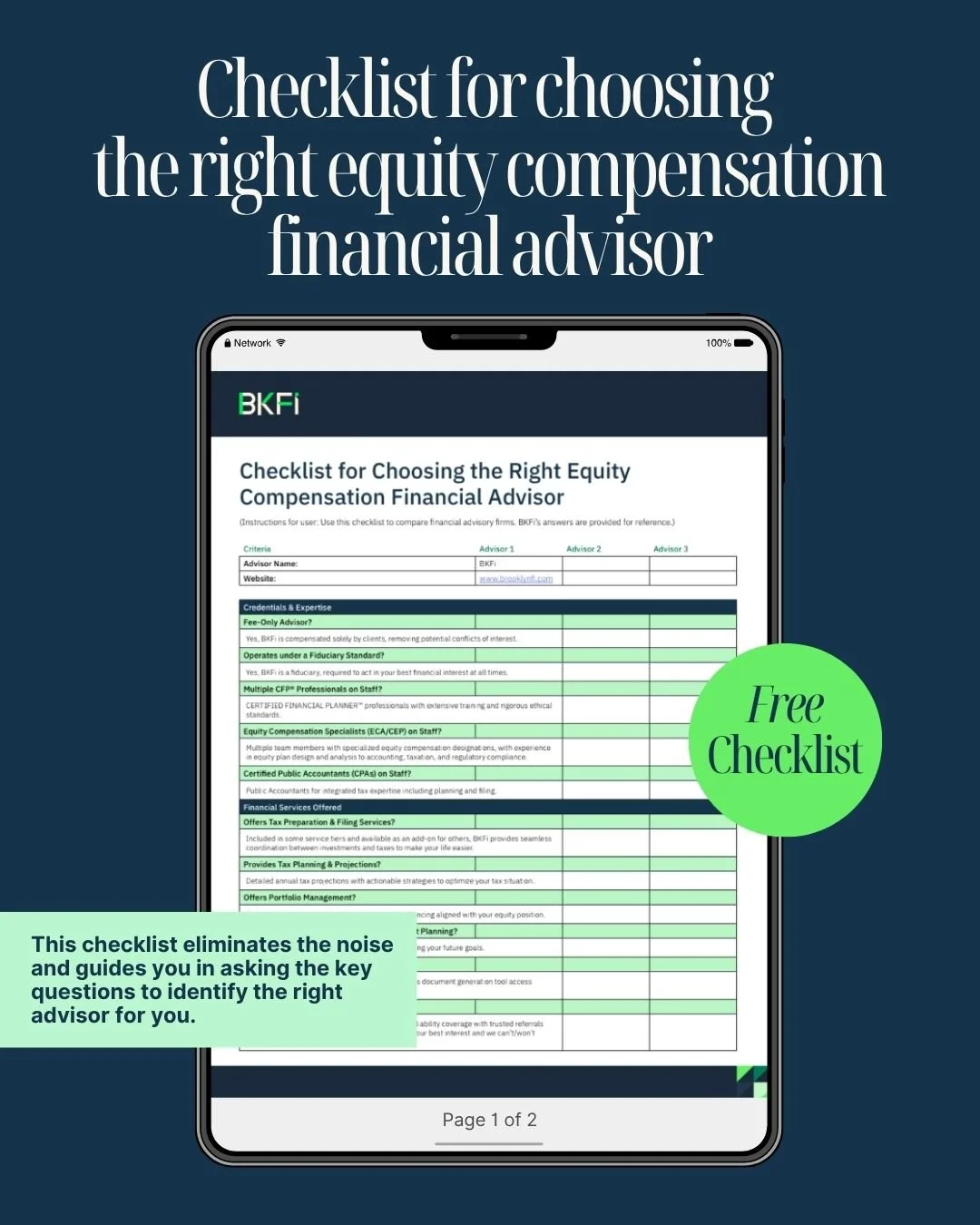

Free Advisor Checklist

Finding the right advisor starts with ASKING the right questions

Get the checklist that makes choosing easy.

You’ve got stock options, RSUs, or other equity compensation. Now you need an advisor who gets it (and won’t mess it up).

This checklist lets you ask the right questions. Use it to help you choose the best option for your situation:

Equity & Tax Expertise: Do they full understand the nitty-gritty of your specific equity situation?

Comprehensive Planning: Are they able to integrate your equity decisions into an overall financial plan for your goals?

Pricing: Is their pricing structure clear & transparent?

What's in the Equity Advisor Checklist?

Forget generic advice for choosing an advisor. Our checklist focuses on what should matter for you & your money.

Use it to find someone who can:

Provide Deep Equity & Tax Expertise (Not Just Buzzwords): Uncover if they genuinely understand the nitty-gritty of your specific equity (RSUs, ISOs, NSOs, ESPPs), navigate complex tax implications like the AMT, and have experience with scenarios like IPOs or acquisitions.

Demonstrate True Fiduciary Commitment & Transparent Fees: Quickly verify how they get paid.

Showcase Specific Experience with Your Unique Situation: Determine if they have a strong track record advising clients with similar equity profiles, career stages (e.g., pre-IPO, publicly traded executive), and financial goals.

Integrate Your Equity into a Cohesive Financial Plan: Ensure they don't just look at your equity in a vacuum, but can weave it into your broader financial life, including tax planning, investments, and long-term goals - all in a way that makes sense.

What this means for you: Skip the advisors who are all talk and find a partner to optimize your hard-earned equity, minus the expensive mistakes.

Like us already?

We developed this checklist after helping clients optimize billions of dollars in equity compensation. If you think we're a match, let’s talk.