Digital Event: What The One Big Beautiful Bill Act Means For You

The One Big Beautiful Bill Act is here, and what does that mean for you?

Big tax law changes are coming in 2025 and 2026, including shifts to deductions, credits, and equity compensation. This post outlines what’s changing and key planning moves for high earners, families, and business owners.

What Is Staying The Same:

Tax brackets from 2017 were made permanent

QBI Deduction made permanent

Corporate tax rate is unchanged

QBI Deduction still limited for service businesses

Changes For Equity Professionals and High Earners:

QSBS Updates: Bigger Exclusions, Bigger Opportunity

Qualified Small Business Stock (QSBS) rules got a major upgrade. The tax-free gain exclusion increased from $10 million to $15 million and will now be indexed for inflation. Plus, partial exclusions are allowed after 3 years of holding, with full exclusions at 5 years.

Action Step: Review QSBS eligibility as part of your diversification strategy.

AMT is Back (and Hits Harder in 2026)

The Alternative Minimum Tax (AMT) phaseout is tightening, with the exemption now reduced by 50% over the threshold (up from 25%). This means more folks — especially those exercising ISOs — may get hit with AMT starting in 2026. Also, expanded SALT deductions could trigger more AMT exposure.

Action Step: Consider exercising ISOs in 2025 before new rules apply.

SALT Deduction: Expanded, But With a Steep Phaseout

The SALT deduction increases to $40,000 in 2025 and is indexed annually until 2029 — but it phases out quickly for those earning over $500,000. Once income hits $600,000, the deduction drops back to $10,000. In 2030, the cap returns to $10,000 for everyone.

Action Step: If you're near the phaseout, now’s the time to strategize deductions over multiple years.

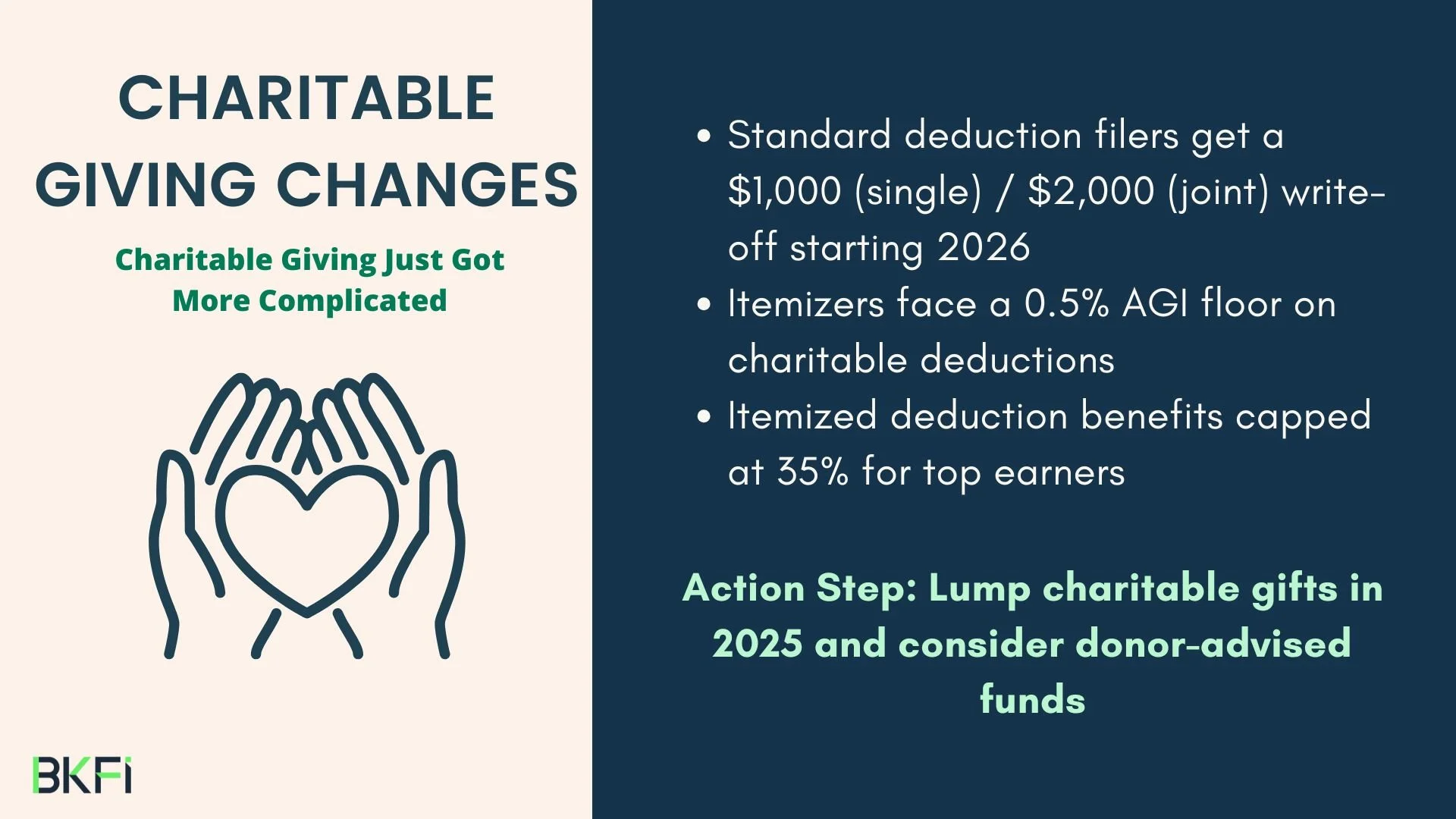

Charitable Giving Just Got More Complicated

Standard deduction filers can write off $1,000 (single) or $2,000 (joint) in charitable contributions starting in 2026. But itemizers face a 0.5% AGI floor before deductions apply, and top earners will see their deduction benefit capped at 35%.

Action Step: Consider bunching charitable donations into 2025 and using donor-advised funds to maximize value.

W-2 Earners, Expect Higher Taxes

High-income W-2 earners will see modest tax increases due to the SALT cap, reduced itemized deduction benefits (by 2/37ths), and new charitable deduction floors.

Example: A W-2 earner making $1M could see $3,500+ in higher taxes starting in 2026, even with similar deductions.

Action Step: Consider charitable lumping and multi-year planning before the new rules hit.

Changes For Business Owners:

QBI Deduction Changes: More Business Owners Now Qualify

The 20% Qualified Business Income (QBI) deduction is now permanent. Income phaseout thresholds increased to $75,000 (single) and $150,000 (joint), making the benefit more widely available. A new $400 minimum deduction applies to small business owners with just $1,000 in income.

Action Step: Reassess QBI eligibility under new rules.

Bonus Depreciation is Back and Bigger

Full 100% bonus depreciation is restored and made permanent (previously phasing out by 2027). This means major upfront tax deductions for capital investments. A new category, Section 168(n), was added for nonresidential real property, and Section 179 expensing now has a $2.5M annual cap.

Action Step: Reevaluate capital investment plans for your business, and know your state rules.

1099 Thresholds Are Changing, But Not Right Away

Starting in 2026, platforms like Venmo and Etsy will only send you a 1099-K if you have over 200 transactions and $20,000 in revenue. Meanwhile, the 1099-MISC and NEC reporting thresholds rise from $600 to $2,000 (indexed for inflation).

Action Step: Be aware of reporting changes and stay current on platform-specific thresholds.

Families: Modest Relief and More Flexibility

Families see modest wins:

Child Tax Credit increased to $2,200

Dependent Care FSA limit now $7,500

529 plans more flexible for education

New IRA option for minor children

Estate tax exemption raised to $15M per person and made permanent

Action Step: Maximize available credits and savings vehicles

New Deductions for Workers and Retirees

Several targeted deductions are now available:

Standard deduction bumped by $750/$1,500

Seniors 65+ get a $6,000 deduction each

New deductions for overtime, auto loan interest, and tips — all phased out for high incomes

Action Step: Plan ahead if you’re eligible — phaseouts begin at $100K–$300K, depending on the deduction

Expiring Energy Credits: A Final Push Before They’re Gone

Several clean energy and electric vehicle credits are being repealed starting in late 2025:

EV & home energy efficiency credits

Refueling property deductions

Commercial and residential energy credits

Action Step: Consider energy-efficient investments before key deadlines.

Key Takeaways & Next Steps

What Can You Do Now?

Plan charitable giving strategies before 2026

Review equity compensation and QSBS opportunities

Optimize deductions and deferrals before phaseouts hit

Understand how income thresholds affect your taxes

Get ahead with proactive planning for both 2025 and 2026