DISCLAIMER:

Case studies are presented for educational and demonstrational purposes only. Case studies do not reflect an actual client's income and are not to be viewed as a guarantee of future results from hiring Brooklyn FI, LLC for advisory services.

Meet, Annabelle!

Annabelle

Annabelle is a UX designer. She gets a job at Snowdrift, a SaaS company founded by her roommate's cousin. Annabelle is the seventh employee at Snowdrift and although she takes a significant salary cut, she is rewarded handsomely with incentive stock options, specifically with 20,000 ISOs at a strike price of $0.56 that vest in three equal installments over three years.

Annabelle’s DIY Financial Planning

VS.

BKFi Financial Planning

Let's see what happens when equity experts like BKFi get involved.

Year 1

FMV $0.56

Events

She does nothing, she's not sure what the 30-page equity plan means.

Her advisor discovers the early exercise component. The advisor is able to quickly point out the advantages of the 83(b) election and together they decide that Annabelle is willing to risk $5,000 to early exercise and freeze the taxes on 8,928 shares of her options. There is $0 tax liability generated because the FMV of Snowdrift is still at Annabelle's exercise price of $.56.

Action

NOTHING

Exercise 8,928 options for cost of $5,000. AMT due: $0

Shares Held

0 - ZERO

8,928 Shares

Unexercised

20,000 shares

11,072 shares

Post-Tax Proceeds

$0

$0

Income Tax Due

$0

$0

AMT Due

$0

$0

Year 2

NO ACTION

NO ACTION

Year 3

Annabelle's options have now all vested. Snowdrift is growing quickly. There are now 40 employees and the founders are raising additional capital. In order to not further dilute their ownership they offer up employee held equity to the new investors through a secondary sale at the current valuation of $12.00 per share.

FMV: $12.00

Events

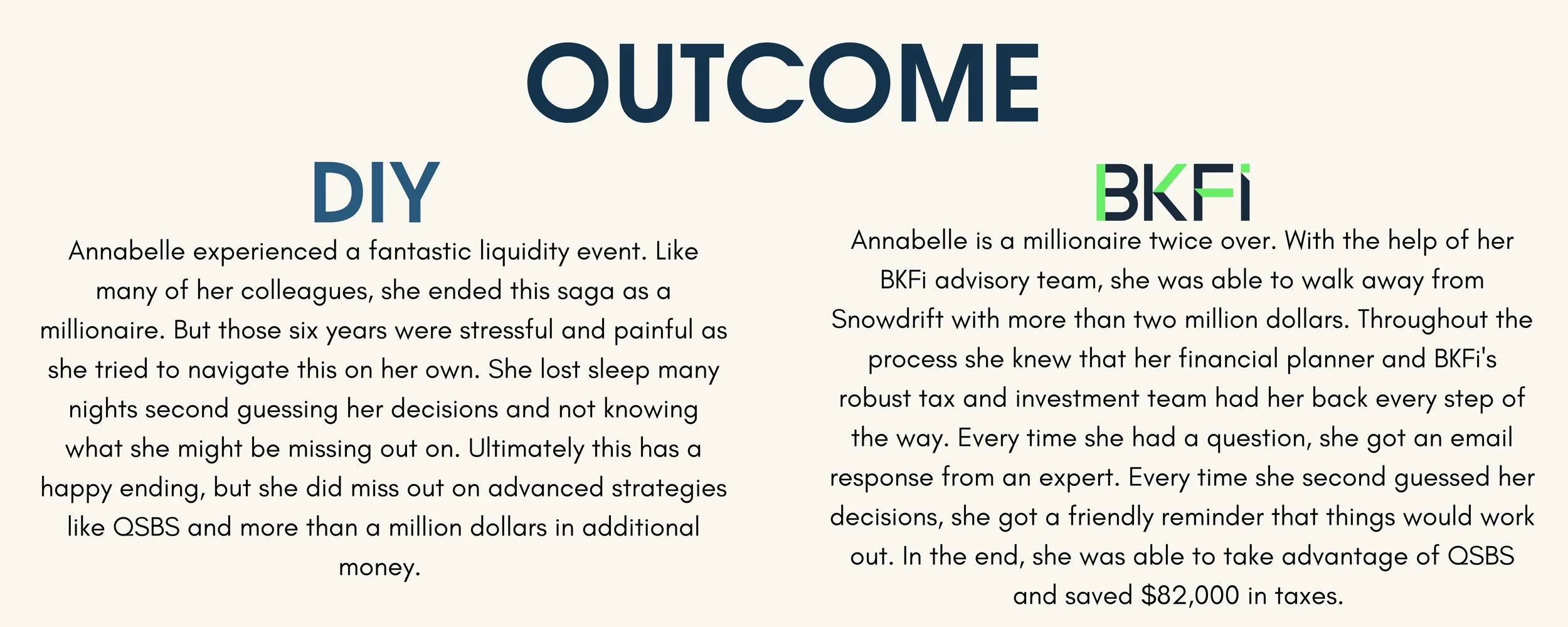

Annabelle is excited to finally get some cash out of Snowdrift. She decides to sell 20% of her holdings. Because she is going to exercise and sell her options on the same day to the new investors, she'll pay regular income tax on the transaction. She isn't sure what to do with the cash proceeds so she keeps it in a savings account.

She emails the advisor with the news and they hop on a call the very next day. During the meeting, the advisor is able to instantly model three different scenarios live in about five minutes. This gives them ample time to catch up and decide if Anabelle should sell or exercise. Annabelle is bullish on Snowdrift and wonders if she should exercise more of her options but wants to understand the tax consequences. Together they decide that Annabelle will sell just enough of her holdings to finance an exercise of another 5,000 shares and pay the AMT. Annabelle knows her AMT bill almost 8 months ahead of time so it's not a surprise.

Action

Sell 4,000 options for a gross of $48,000. She pays regular income tax at about 38%.

Same day sell 300 shares and exercise 5,000 options to hold. AMT Tax due!

Shares held

0 - ZERO

13,928 Shares

Unexercised

16,000 shares

5,772 shares

Post-Tax Proceeds

$29,760

-$13,784

Income Tax Due

$18,240

$1,368

AMT Due

$0

$16,016

YEAR 5

After months of rumours, on a cold February morning, Anabelle receives news in an all-company email that Snowdrift has filed to go public with the IPO targeted for late March.

FMV: $12.00

Events

Annabelle is excited and starts asking around for help. Someone in the company Slack channel recommends she reach out to a tax advisor now ahead of the IPO. But it's February and every CPA and CFP she reaches out to can't take her call for months because it's tax season. Afraid of the tax consequences, she doesn't take any action.

The advisor runs through the Brooklyn FI IPO checklist and asks Anabelle about QSBS (Qualified Small Business Stock). Snowflake's general counsel confirms that the assets of the company in Year 1 were less than $50 million and the shares that Anabelle exercised 5 years ago now qualify for the exclusion. They have no idea what the IPO price will be so they try a few different targets. During a 30-minute meeting, they decide together that Annabelle should exercise what she can now to start the long term capital gains clock and then sell her existing shares on the day of the IPO. She knows she has a big AMT bill coming the following April but she is confident that she will be able to sell these shares in 12 months for long term capital gains treatment with plenty of profit to pay the tax bill.

Action

NO ACTION

Anabelle is confident in this strategy and completes the exercise of her remaining shares. She dips into her savings to cover the exercise cost of $3,232.

Shares held

0 - ZERO

19,700 Shares

Unexercised

16,000 shares

0 - ZERO

Post-Tax Proceeds

$0

$0

Income Tax Due

$0

$0

AMT Due

$0

$0

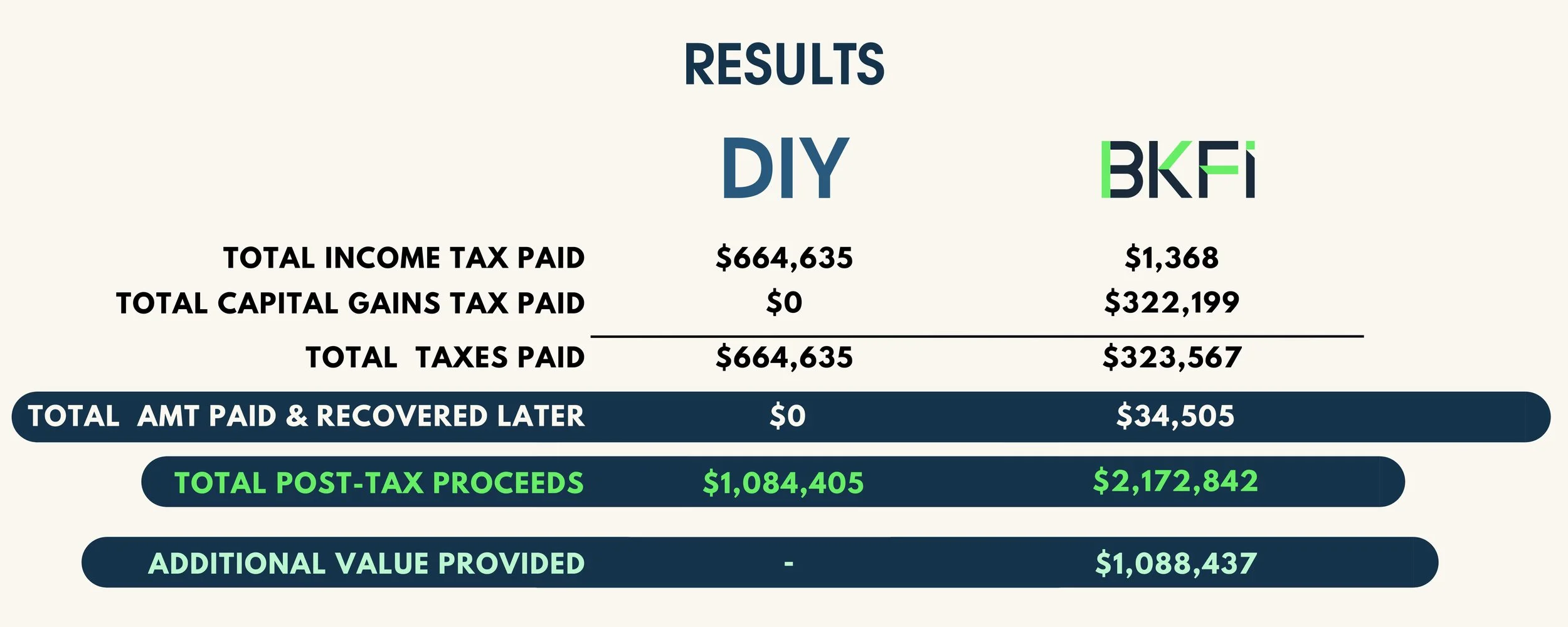

SNOWDRIFT’S IPO

Snowdrift goes public and trading on day one is WILD. The shares open at a price of $75 and jump to $125 by the time the closing bell rings.

FMV: $100.00

Events

Annabelle and her colleagues spend the day watching the stock price. She hears her colleagues talk about all kinds of strategies for maximizing their profits. She feels left out knowing she hasn't made any moves. When the stock hits $100, she has a gut feeling she should do something so she decides to disqualify another 5,000 options through a same day sale.

Due to a lockup agreement, Annabelle is permitted to sell up to 30% of her holdings during the first trading window (3,940 shares). She puts in a market order to ensure the transaction completes on the first day of trading.

Action

Same day sale of 5,000 options

She decided to sell 20% of her holdings which is 3,940 shares. Most of this gain is taxed at the 15% capital gains tax rate.

Shares held

0 - ZERO

15,760 Shares

Unexercised

11,000 shares

0 - ZERO

Post-Tax Proceeds

$308,264

$394,000

Income tax due

Capital Gains Tax Due

$188,936

-

$0

$0

AMT Due

$0

$0

^This income tax number should be $59,100 but because of the QSBS, it's $0. All 3,940 shares are completely tax free due to the exclusion (she has held the original 8,928 shares for 5 years).

YEAR 6

To make things simple and wrap up this saga, let's say it's a year later and Annabelle wants to be completely diversified out of Snowdrift.

$110.00

Events

Annabelle sees her colleagues purchasing homes, taking fabulous vacations and quitting their jobs. She wants in on the action so she sells her remaining holdings.

Using the "Mock 10b5-1 Plan" created by BKFi, the advisor is able to implement a structured sell off during each of her trading windows. Because she's able to sell at different point throughout the year, she's able to get an average sales price that's 20% higher than just selling all at once. Her average sales price is $132.

Action

Same day sale of 11,000 options.

Sells remaining 15,760 shares through a structured trading plan executed by Brooklyn FI. The sale happens while Annabelle is out of the office on a weeklong meditation retreat.

Shares held

0 - ZERO

0 - ZERO

Unexercised

0 - ZERO

0 - ZERO

Post-Tax Proceeds

$746,381

$1,792,626

Income Tax Due

$457,459

$0

Capital Gains Tax Due

$0

$287,694

AMT Due

$0

$0

^There are 4,988 remaining shares of the original exercise which are completely excluded from taxation. She saved $82,302 because of the QSBS exclusion.

DISCLAIMER:

Case studies are presented for educational and demonstrational purposes only. Case studies do not reflect an actual client's income and are not to be viewed as a guarantee of future results from hiring Brooklyn FI, LLC for advisory services.