The BKFi Guide to Tax Return Extensions

What is an extension and how do I get one?

An extension is a request for an extra 6 months to file your tax returns. Individuals: October 15th. S-corps and partnerships: September 15th.

It is NOT an extension to pay any tax due, that’s why you’re reading this page :) You still need to pay an “estimate” by the original deadlines of March 15th (s-corp, partnership) and April 15th (individuals).

An extension is NOT A BAD THING. It is a GOOD THING. It gives you + us more time to analyze your data, ultimately preventing costly errors.

An extension is NOT an estimated payment! An extension pushes back the PRIOR YEAR tax return due date. An estimated payment is a prepayment of your taxes for the year we are CURRENTLY in.

So if I’m going on extension, how do I know what my estimated payment should be for the current year?

If you’re a client that was with us prior to December, 2025, then you received a tax projection from us. That tax projection contains our recommended payment which was tailored to your specific tax liability. If you made the estimated payment as we recommended, then we project that you will not have any additional balances due. Keep in mind that projections take into account forecasting income and using some assumptions. Final numbers may change.

If you did not receive a tax projection from us, then you can do what’s called a “safe-harbor” payment. If you pay 110% of what you paid last year, the IRS will be satisfied and won’t charge underpayment penalties for estimated tax (keep reading for additional penalties).

IF you still need help send an email to your tax manager or financial planner.

So if I’m going on extension, how do I know what my CURRENT YEAR Q1 estimated payment should be?

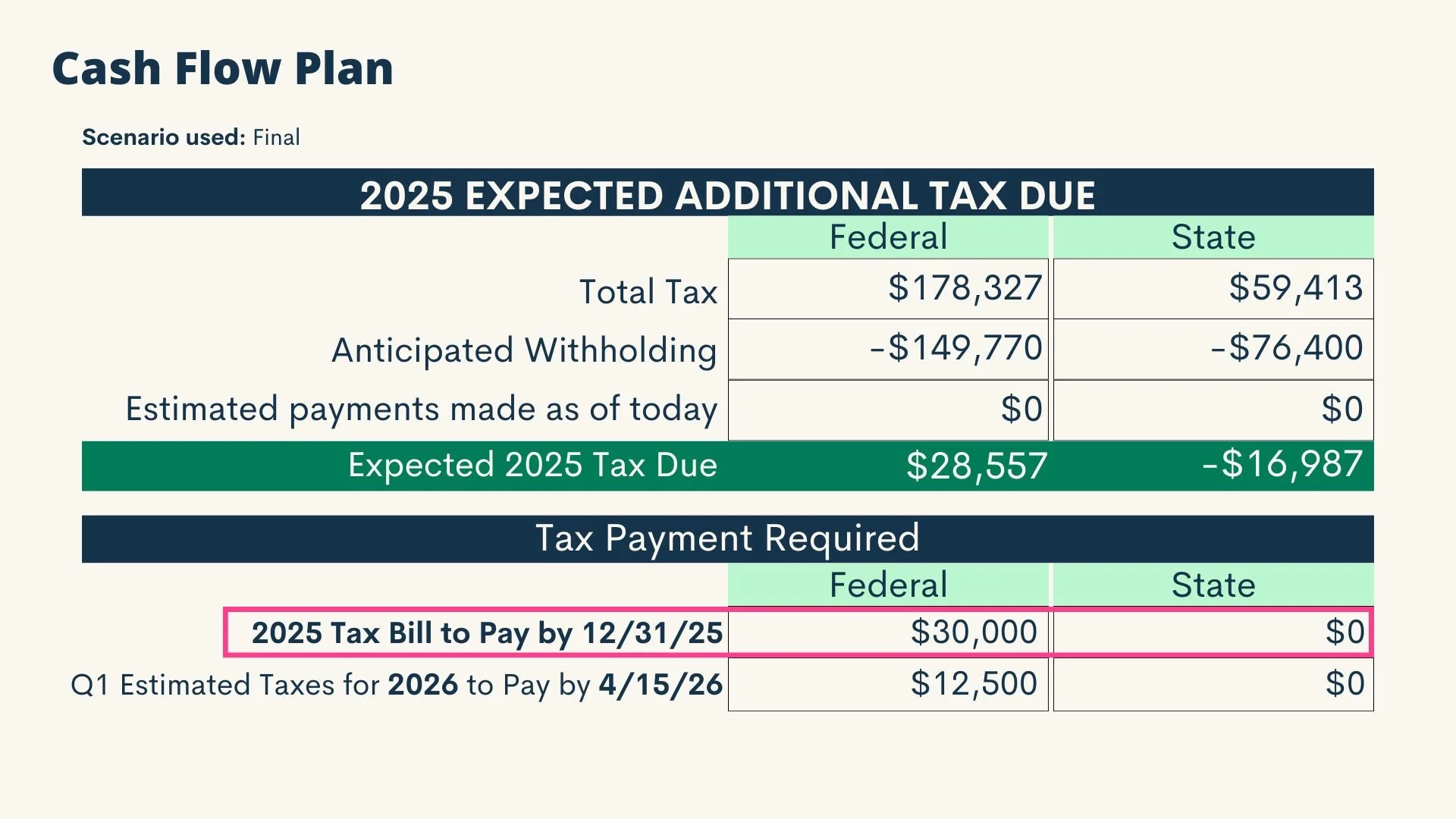

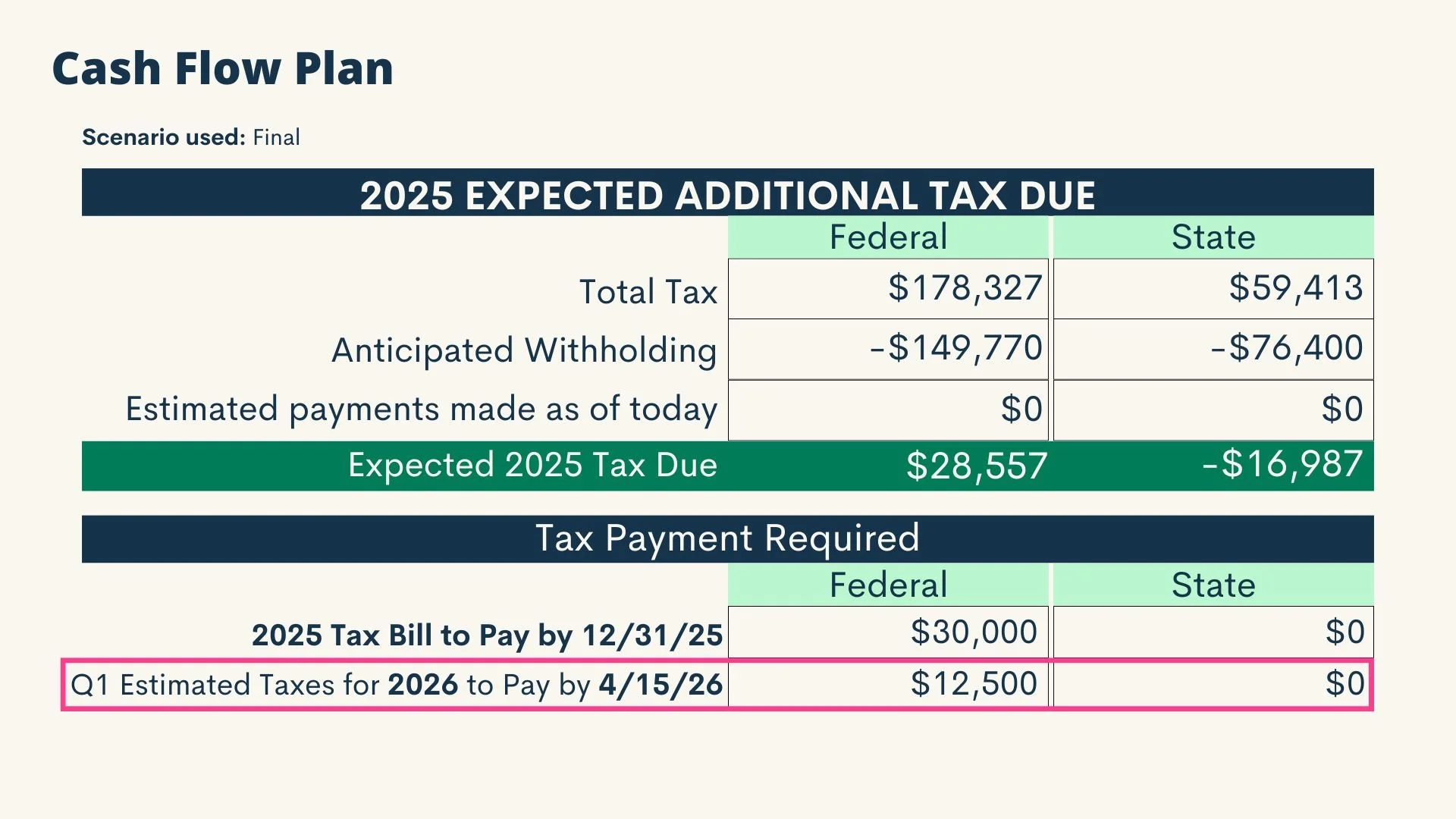

Our recommendation for this scenario is to base your CURRENT YEAR Q1 estimated payment based upon the tax projection we completed for you. As part of your deliverable, there is a row item for projected Q2 estimated tax payments. See screenshot below.

If you are a new client who has not received a tax projection or did not have a Year-End Tax Planning Meeting, then please use the safe harbor method outlined above. We will help you true up your payments when we file your tax return and again when we complete your tax projection towards the end of the year.

Federal DIY extension payment calculation for individuals

On your 2025 federal tax return, go to line 24 on page 2: that’s the total tax owed. Multiply that number x 1.10, then subtract what you’ve already paid via paycheck withholding. You’ll want to divide the result by 4 since we’re making the first quarterly payment. Here’s how to make a payment.

Remember: this is the total tax last year, not the amount you paid or were refunded when you filed the return.

New York DIY extension payment calculation for individuals

On your 2025 New York tax return, go to line 61: that’s the total tax owed. Multiply that number x 1.10, then subtract what you’ve already paid via paycheck withholding. You’ll want to divide the result by 4 since we’re making the first quarterly payment. Here’s how to make a payment.

If you only have enough $ to make a partial payment, we recommend you make it to NY.

Are there penalties if I don’t file an extension or don’t pay on time?

TL;DR: YES.

Failure to file a tax return by the deadline with no extension: 5% per month of the tax due. <<YIKES, right? Let’s get that extension filed.

Failure to PAY your balance due by the deadline: 0.5% of tax due per month, up to 25% of the balance due. <<A lot less but still brutal.

Here’s a complete explanation of penalties from the IRS.

And don’t forget about your STATE taxes.New York charges similar penalties.