Thanks for Booking!

Here’s what to expect!

Before the call…

Watch our introductory video ^^^which will answer a lot of questions. (9 minutes)

Read about how we deliver value to our clients. (5 minutes)

Watch our detailed demo of the financial planning process right from your phone. (25 minutes)

Read a detailed brochure summarizing everything we do (10 minutes)

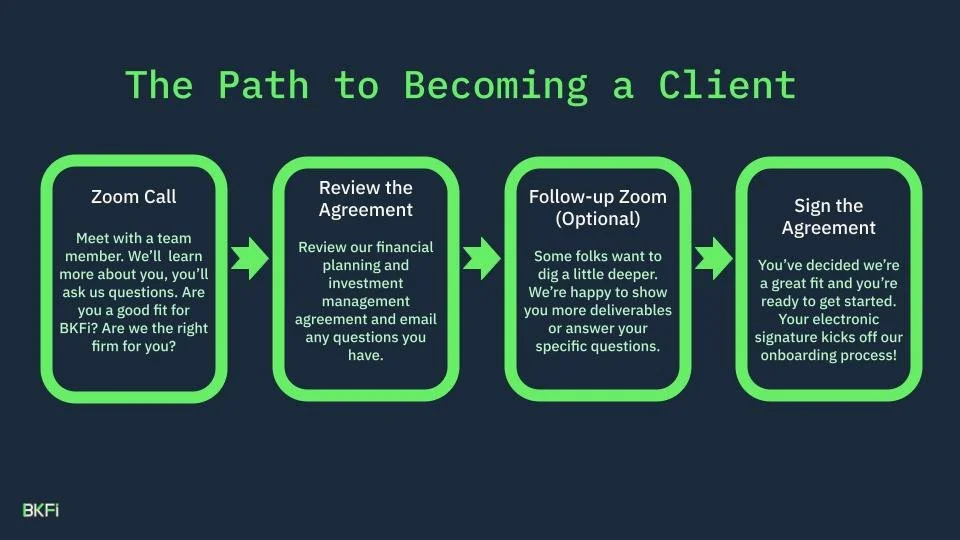

Some folks are ready to sign the contract and get started after a 20-minute call and some folks prefer to book a follow-up video meeting.

What to Expect From a Relationship With BKFi

What makes me a great fit for BKFi?

I’m looking at making a big financial decision in the next year or two. Examples: buying a home, changing jobs, or starting a family.

I have new complexity in my financial life, and I think it’s time to get some help.

I’m working at a company that issues equity compensation in the form of stock options or RSUs and I want to make a plan.

I have a household income of at least $200,000.

What do I get with BKFi?

Access to a team of financial and tax experts (CFP®s and CPAs) led by one point of contact. Meet the team.

Preparation and filing of your federal and state tax returns

Proactive tax planning: we complete an annual tax projection in the fall so you have insight into your tax return six months before its due – this allows you to actually make changes within the year that can lower what you may owe.

A low-cost, ultra-tax-efficient investment portfolio managed by experts. Read about our investment philosophy.

A cloud-based financial planning dashboard to view your financial life today and decades into the future. Sign Up here.

What’s so unique about BKFi?

We combine tax planning, financial planning, and investment management in one place.

We leave no stone unturned and truly optimize your financial life.

BKFi clients sleep well knowing they have a team of experienced professionals looking out for them and their growing wealth.

It’s extremely rare to find a firm like ours where taxes and investments are done in-house.

What happens when I’m a client?

Access to a CERTIFIED FINANCIAL PLANNER™

It’s the gold standard in the industry for well-rounded financial advice.

BKFi CFP®s are experienced and work with dozens of clients JUST like you.

With a BKFi relationship, you have unlimited access to your CFP®.

Your financial planner is well-versed in many topics, not just investments.

Life Planning – aka figuring out your goals and your “why.”

Cash flow planning – how much does it cost to live your life?

Retirement planning – will you have enough money for the future?

Insurance – is my family and my wealth protected from the unknown?

College funding – how to use the tax code to save for this expensive purchase.

Implementation Support

We don’t just deliver a financial plan and send you on your way. You get custom post-meeting follow-ups with specific recommendations and clear instructions.

Access to RightCapital

Right Capital is a cloud-based financial modeling tool with a beautifully designed dashboard and direct links to your bank accounts, credit cards, and investment accounts. Sign up here and play around. Or watch a quick demo.

Your financial plan lives in Right Capital and is a living, breathing model of your financial picture today and years into the future. We can model different scenarios as your life changes. Here are just a few examples:

Buying a house and what price makes sense.

Moving to a new state (or a new country!)

Quit your job for a while!

Take a lower-paying job.

Retire early.Have a child or adopt a child

Provide support to a parent or loved one

Investment Management

Investment Management with a Fiduciary

At BKFi, we have a Fiduciary responsibility to place your investable assets in the right place. For example, if you’re saving for a home purchase next year, the best place for your cash might be a high-yield savings account.

Most firms just ask you how much you have to invest, but at BKFi, we actually take time to understand your cash flow needs and goals before we invest. We call this an Investment Plan.

How much cash do you need in an emergency fund?

Do you have any short-term cash needs like saving for a home purchase?

How much of your net worth should be set aside for alternative investments (like crypto, early-stage companies, real estate, etc.)?

How you can benefit from the value of professional portfolio management

Avoiding the “Christmas Problem” - many DIY-ers miss out on big market moves because they are simply busy living their lives.

Our fiduciary advisors will help educate and inform you to make the right investing decisions.

Having a trusted partner to guide you through market volatility. Will you really be able to stay invested during the next financial crisis? Even brilliant investors are not immune from emotion. Here’s John on finding calm in waves of volatility.

“Set it and forget it” is a great portfolio strategy for beginner investors. When the numbers get bigger and taxes matter, most investors can benefit from an optimized portfolio.

Our fiduciary advisors will help educate and inform you to make the right investing decisions. Here’s AJ on avoiding unnecessary complexity.

Executing the Strategy

Our clients’ portfolios are housed at the brokerage firm Charles Schwab. We typically manage taxable investment accounts, IRAs (Traditional, Roth, SEP), and Solo 401(k)s.

We use a mix of low-cost ETFs and mutual funds to build ultra-tax-efficient portfolios customized to each client’s goals and investing horizon.

We’re not afraid of tax-efficient complex strategies.

Back door Roth IRAs

Targeted tax-loss harvesting

Targeted rebalancing (at least quarterly, but sometimes weekly during periods of market volatility

We can take “custody” of your equity compensation accounts and actually sell your RSUs and stock options for you.

Login to the account via your credentials and execute trades.

The biggest threat to a windfall is not executing the trades; with custody, someone else pushes the button for you and moves the money to get invested in a ‘real’ portfolio.

Having a trusted partner to guide you through market volatility. Will you really be able to stay invested during the next financial crisis? Here’s John on finding calm in waves of volatility.

We assist with rollover and consolidating 401(k)s from previous employers.

Tax Planning and Filing

We use year-to-date information to predict what your tax bill will be in the future. As needed and typically in the fall, your CPA prepares a tax projection to discuss with your financial planner.

We file your individual tax return. Your CPA will record a personalized time-saving video review of your tax return walking you through the income, expenses, investments, etc. that impacted your tax number. You also have the option to book a meeting to discuss any questions. Clients find this unique deliverable invaluable!

You will have access to a dedicated CPA who is available to answer any tax questions you have.

For Those Going Through an IPO, tender offer, or acquisition.

This is what we’re GREAT at! Read about how to prepare for an IPO.

Accelerated meeting schedule to meet your tight exercise and sell deadlines. Yes, we can help you THIS week.

An IPO Trading Plan is built with your planner so you feel confident in a plan to diversify your holdings while understanding restrictions.

Equity Management for Stock Options and RSUs

Access to BKFi’s proprietary equity tool GEM to hold your equity inventory and test the cash flow and tax implications of different scenarios and outcomes.

When to exercise and hold stock options.

How much to withhold on RSUs and how to avoid surprise tax bills

Understanding and minimizing Alternative Minimum Tax (AMT) on ISOs.

Building Trading Plans

Creating 10b(5)-1 plans with your employer.

Understanding advanced tax strategies like Qualified Small Business Stock. Read more about QSBS.

What Does it Cost?

We don’t have asset minimums. Our fee is comprised of two parts:

Financial planning and tax preparation fee: an annual retainer fee based on complexity. Read about our transparent pricing. The annual retainer fee is divided into 12 monthly payments.

Asset management: a quarterly fee paid as a percentage of assets managed. Read about our asset management philosophy and fee structure.

Our goal is to get your portfolio up and running and on the path to financial independence as fast as possible. There are discounts available at certain levels:

When BKFi is managing $500,000 - $2,000,000, the annual retainer fee is reduced 50%

Example: Bill and Julia’s calculated retainer fee is $8,100 which they pay as a monthly installment of $675. Bill begins to diversify his Google RSUs and moves $550,000 to a diversified portfolio at Schwab managed by BKFi. The next month Bill and Julia’s monthly retainer fee is reduced to $337 and they pay the annual asset management fee of 0.90% on the $550,000 quarterly on an average daily balance of that account.

When BKFi is managing $2,000,000 or more, there is no annual retainer fee, only the asset management fee.

We require one year of commitment. After that first year, the engagement may be canceled at any time.

By working with a fiduciary, you are the only one paying for our advice. We don’t receive any kickbacks or commissions from investments we recommend. Unlike a traditional asset manager paid through mutual fund fees or an insurance broker paid through commissions on products, the fee comes directly from you. This is often a big adjustment for many of our clients who have never worked with an advisor before.

We only work with clients where we know we can provide value. We may discover on our first call that we aren’t a great fit, and that’s okay.